La nostra MISSIÓ es oferir una experiència enmig de la natura, i que el client gaudeixi de la tranquil·litat, qualitat i originalitat d’aquesta, valorant una nova forma de fer, aconseguint una trobada amb amics i familiars mes sostenible i privada.

Els nostres VALORS són poder gaudir de l’entorn natural que ens envolta d’una manera mes saludable, i donant especial atenció a tots els detalls que oferim per poder personalitzar cada experiència al màxim, intentant proporcionar productes locals o de Km0.

Hem desenvolupat aquesta idea de negoci amb la VISIÓ d’un lloc autèntic, original i sostenible per a tota persona que li agradi la natura.

A La Flama Canyamars vetllarem per tal que la teva estada, sigui única i especial.

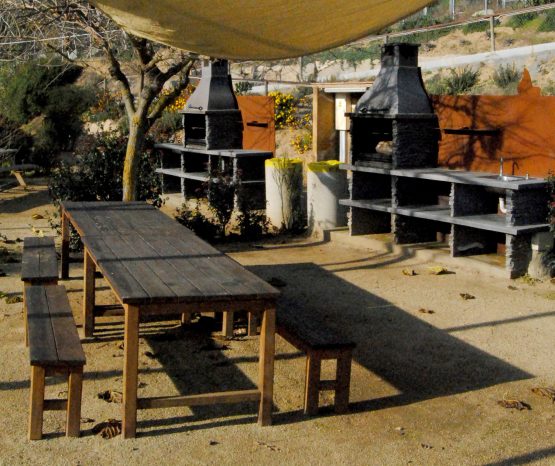

Disposem de 18 espais de 100m2 per gaudir de moments únics i privats fent una barbacoa, jugant, i coneixent el món natural i sostenible que oferim.

Formem part del projecte de Sostenibilitat turística Biosphere, oferint productes i serveis que no comprometin a les generacions futures, i un model de turisme no agressiu amb el medi natural que ens envolta.

Ens agraden molt els animals i encara més que els porteu amb vosaltres, per tant, la vostra mascota és benvinguda a les nostres instal·lacions! Només ha de complir una sèrie de normatives per tal que tothom pugui gaudir del dia